Single Touch Payroll

What is a Single Touch Payroll?

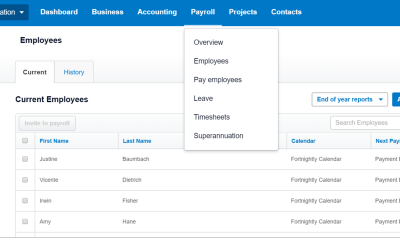

Single Touch Payroll (STP) is the method by which you report your employees tax and super information to the ATO (Australian Taxation Office).

Single Touch Payroll (STP) is the method by which you report your employees tax and super information to the ATO (Australian Taxation Office).

By using STP you are reporting your employees’ payroll information to the ATO each time you pay them through STP integrated software. Payroll information includes salaries and wages, pay as you go (PAYG) withholding and superannuation. The Australian Tax Office uses payroll data to verify employees’ superannuation and check if they’re eligible for government assistance programs like JobKeeper.

STP phase 1 came into effect in July 2018 and STP Phase 2 is the latest iteration of Single Touch Payroll and launched at the beginning of 2022. STP Phase 2 is the next update for the SRP system which aims to make it easier for employers to report specific payment details made to employees across all income streams.

The main things changing in this phase are tax file number declarations, employee separation certificates, lump sum e-payments and child support. The phase 2 expansion of STP will allow payroll data to be utilised by other government agencies, including Services Australia.

Getting STP2 wrong can have a major impact on an employee’s life, as it may lead to them doing incorrect tax returns or having social security such as COVID payment applications rejected.

On the other hand, it will less work for employers and employees alike by reducing the need to file reports with multiple agencies.

How does this affect my business?

STP Phase 2 is likely to impact all businesses that employ staff.

These changes coming in Phase 2 will mean at least a minor adjustment to payroll processes for all employers with the length of additional reporting depending on the size, structure and type of employees in each individual organisation.

For more information on Single Touch Payroll Phase 2 and how it could affect your business get in touch with our STP experts by clicking on the button below to ensure you are ready and compliant